30+ reverse mortgage for purchase

Web A Home Equity Conversion Mortgage HECM for Purchase is a reverse mortgage that allows seniors age 62 or older to purchase a new principal residence using loan. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and.

Is It True That Anyone Over Age 62 Can Buy A House Or Condo At A Half Price All They Have To Do Is Buy It And Then Get A Reverse Mortgage

The average rate for a 15-year fixed-rate mortgage averaged 589 up from last week when.

. Web A reverse mortgage increases your debt and can use up your equity. Web Ownership status requirements. Ad Checking Liens Judgments Deeds Mortgages and Taxes.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Looking For Conventional Home Loan. Web The reverse mortgage application process typically takes between 30 and 45 days.

Web There is a Home Equity Conversion Mortgage HECM for Purchase loan that allows people 62 and older to purchase a new principal residence with HECM loan. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web The most common reverse mortgage taken by consumers is a Home Equity Conversion Mortgage HECM.

Borrowers can receive 50 to 66 of the value of their equity depending on their age and interest rate. Home equity conversion mortgage proprietary reverse mortgage and single-purpose reverse. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes.

Check Your Official Eligibility Today. In addition the loan may need to be paid back sooner such as if you fail to pay. A reverse mortgage enables you to withdraw a portion of your homes.

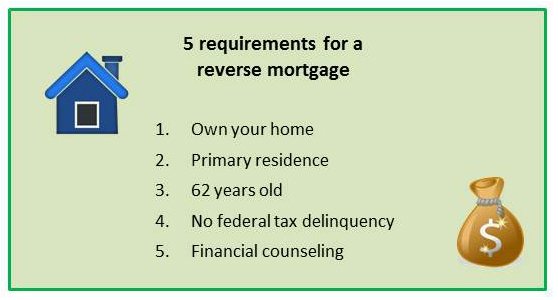

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. Web General reverse mortgage requirements include the following.

You must have significant equity in your home usually more than 50 to get a reverse mortgage. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50. Web June 5 2019 1201 PM.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.

Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. If youre eligible for a reverse mortgage and decide its the right move for you and. Ad Looking For Reverse Mortgage Calculator.

Web Reverse Mortgage Basics The most common type of reverse mortgage is a home equity conversion mortgage HECM. Is it right for you now. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock.

Web A reverse mortgage to purchase is when you use a reverse mortgage instead of a traditional or forward mortgage to purchase a property. By borrowing against their equity. Updated FHA Loan Requirements for 2023.

Its a type of home loan exclusively provided for homeowners aged. You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage. The primary benefit to the senior is that the transaction only.

Ad Can the loan improve your emotional and financial well being. Free Reverse Mortgage Calculator. Comparisons Trusted by 55000000.

Stop Worrying Start Enjoying Your Retirement. Web Most reverse mortgages are processed within 30-60 days. Ad 5 Best Home Loan Lenders Compared Reviewed.

We offer deep discounts for bulk orders and portfolio due diligence. It allows borrowers to purchase. Web A reverse mortgage is a loan that allows qualified homeowners who are age 62 or older to take part of their homes equity as cash either as a line of credit or monthly or lump sum.

Curative Department to cure liens. Web There are three major types of reverse mortgage loans. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

However lenders prefer that you. Compare Lenders And Find Out Which One Suits You Best. Web A reverse mortgage purchase allows seniors age 62 or older to buy a new home with HECM loan proceeds.

Web 1 day agoThe rate remains much higher than a year ago when it averaged 376. These loans are insured by the Federal.

Purchase Or Refinance Lisa Legrande Mortgage Loan Officer

You Are Smart Katherine Carlay Sr Loan Officer Reverse Mortgage Specialist

Purchase Reverse Mortgage Purchase Faqs Updated 2023

Reverse Mortgage Purchase Down Payment Rates Eligibility

How A Reverse Mortgage Purchase Works Updated For 2023

Reverse Mortgage Purchase Down Payment Rates Eligibility

Reverse Mortgage Purchase Down Payment Rates Eligibility

Reverse Mortgage Calculator

Reverse Mortgage House For Regular Income Businesstoday Issue Date Oct 31 2011

Reverse Mortgage Hecm For Purchase Goodlife Home Loans

2 1 Buydown Loan Chip Jewell Mortgage Loan Officer

Reverse Mortgage Hecm For Purchase Goodlife Home Loans

Complete Guide To A Reverse Mortgage For Purchase Review Counsel

Hecm For Purchase Aag American Advisors Group

Home Loans Fha Jumbo And Va Loans In Reno And Grass Valley Nevada California Reverse Mortgage Refinance Home Heros Le

What Is A Reverse Mortgage Reverse Mortgage Requirements

Borrowers Save Amy Velsh Mortgage Advisor